How to Fly for Free with Credit Cards: we saved £1190 on Flights

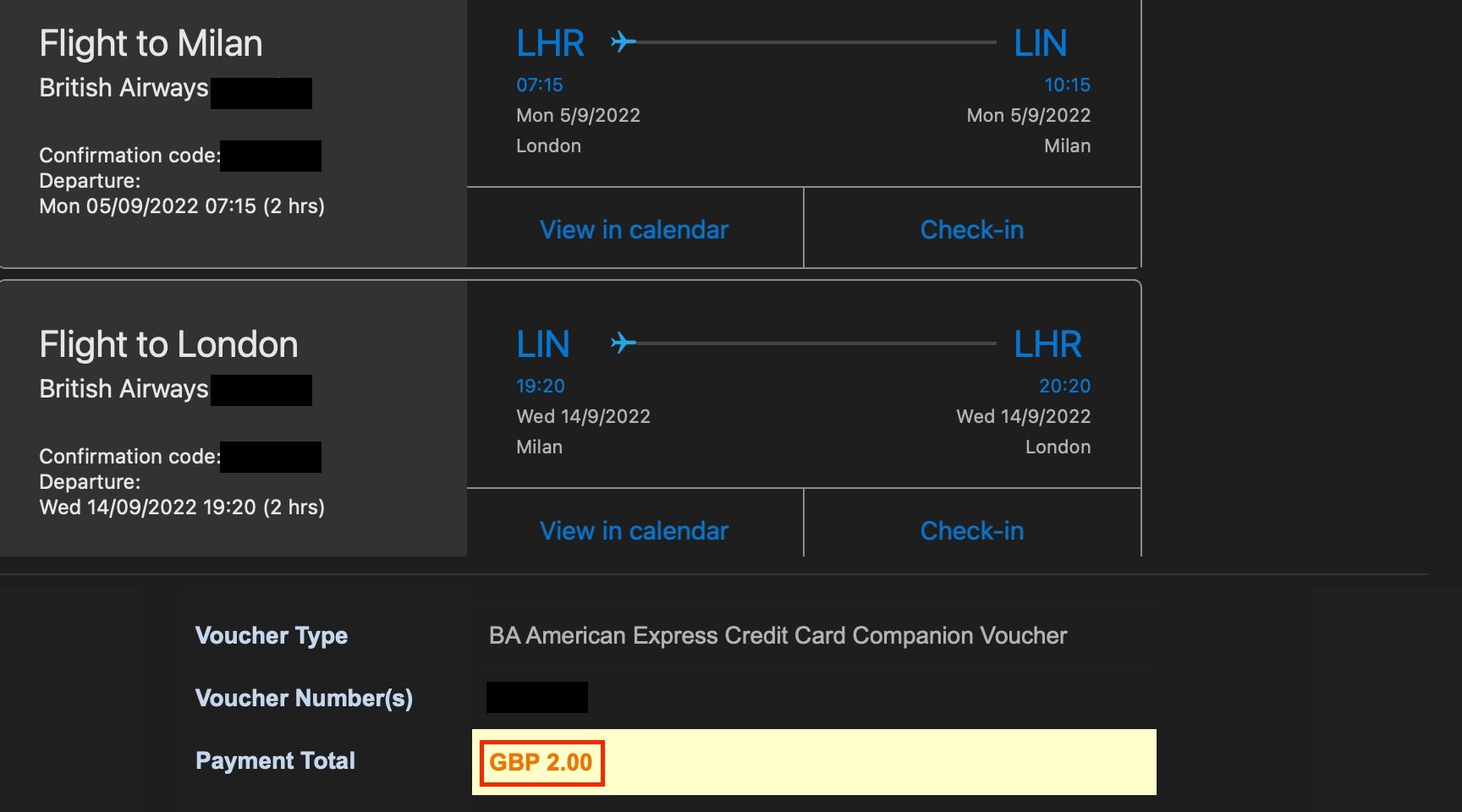

This summer, we flew to Milan in Italy from London Heathrow and back for a total of £2. If we booked that at the time of writing this blog, without the steps we’re going to tell you in this blog, it would cost £1190 for two return tickets.

We wanted to bring together this guide on how to fly for free with credit cards so you can do the same.

If you wanted to take it even further and run your own blog or business that will allow you to travel for free, then you could even stay in business class lounges (like we did). That isn’t for this blog though, feel free to check out Blog Lifestyle Mastery.

Introduction: How We Got Started

The first step to how to fly for free with credit cards is to get a credit card where you can rack up reward points. You get these points for spending money on your card, which you can exchange for flights.

As long as you pay off your card in full at the end of every month, these points are free, meaning you’re getting points for spending on standard stuff like fuel, groceries and nights out.

We would recommend using the British Airways American Express® Credit Card for a number of the following reasons:

They have great signing-on bonuses that give you points you can put towards your flights. For example, using our referral link, you will get 12,000 points if you spend £1,000 total in the first three months - that’s 76% of the points needed for a BA return to Paris from the UK.

Their travel companion offer is incredible - If you spend £12,000 in a membership year, you get a free companion voucher, which allows someone to travel with you for FREE when you buy a flight with your Avios points.

There is no membership fee - With other cards, you have to pay an annual fee. With this BA AMEX, you don’t.

Henry got his BA card in Q1 2021, and within 6 months of just using his card for expenses, weekend trips and general spending, he had 26,000 points - enough for return flights to Milan for us both (with a companion voucher).

NOTE: As we mentioned above, you should always pay off your card balance in full. If you don’t, you will pay interest rates, which defeats the whole point of free travel. You will mess up all the steps to how to fly for free with credit cards if you don’t follow this.

Enjoying a business class lounge in Heathrow Terminal 5 for “free” through our AMEX

How to Begin Getting the Most From Your Credit Cards

If you want to take advantage of your credit card offers and rewards, you must know how to begin getting the most from them. The most common way is using your card for everyday purchases and paying off the monthly balance.

The key to getting the most from your credit cards is to move all spending to them. That means transferring all of your living costs to your BA AMEX Card.

As a result, you will clock up points for the everyday spending that you would do anyway, without even having the card. In other words, you’re making your money work for you.

If you spent £1,000/month (which is doable for most professionals when you account for fuel, groceries, going out, travel, birthdays etc.), by the end of the year, you would have ~24,000 points + plus a travel companion voucher.

That’s enough points for:

2 x return tickets to Paris, Amsterdam, Berlin or Rome

1 x return ticket to New York or Chicago (plus £50 in taxes)

So that’s free flights for a holiday once a year for doing nothing but signing up for a BA AMEX Credit Card. And that’s without the travel hacks we’re going to give you below, which got us into Business Class Lounges and bagged us many more points.

5 Steps to Better Travel Hacking (Advanced)

This section of the article is for people who want to take it to the next level. We’re still early in our travel hacking journey, but feel free to reach out if you’d like to speak to some people who have taught us the ways.

Here are 5 steps to take your travelling experience to the next level and beyond.

1. Use PayPal: Using your credit card, you can’t pay for all of the expenses and monthly payments in your life, but with PayPal, you can pay a lot more than you would think! Some landlords accept payment via PayPal, meaning you could clock up many more points per year by spending money you’ll be spending anyway!

2. Pay for holidays: Going away with your mates? Put it on your credit card. We know it can be a pain to be the one that puts their money on the line, but let’s say you have a group of 6 friends, all spending £1k each on a holiday together; that’s 6,000 extra points for just putting yourself forward.

If you can’t trust your mates to pay you back in time and not put you in a risky position for clocking up interest, you probably need better mates!

3. Check out other AMEX cards: Some people may use the British Airways American Express Premium Plus Card or the Business Platinum Card (like we do) to rack up even more points. These cards have a fee, but you get much more points for that cost. For example, with the Premium Plus BA card, you get 25,000 Avios points for spending £3,000 in your first 3 months, plus 1.5x Avios points for every £1 spent - that’s 43,000 points per year using the above example!

4. Use your business card to your advantage: If you’re a business owner, you can get access to a whole new level of rewards through AMEX’s business range. Henry has a Platinum AMEX through his business, which will likely give him 50,000+ points in the first few months through spending and rewards.

On top of this, certain AMEX business cards will give you complimentary access (plus a guest, below) to business class lounges, meaning you can add that extra style to your holiday.

Yes, there are fees you may have to pay, but when you take advantage of all the benefits, they are 100% worth it, particularly when you use hacks like using PayPal to pay contractors!

5. Combine your spending power: If you’re reading this blog, you’re likely in a couple. You will get double the spending power and travel rewards by getting a joint card or even transferring points. This makes sense if you’re going to use your points on a couple’s getaway as we did during our trip to Italy.

As we’ve said before in this blog, if you’re going to be spending the money anyway, why not get some points?

Still don’t believe us? We bought tickets worth £1190 for £2 and flew to Milan and back. We’ll continue doing the same and documenting it on this blog, so make sure to continue reading future blogs to see the proof in the pudding on how to fly for free with credit cards.

Conclusion: How to Fly for Free with Credit Cards

I think this is where we say, “this is not financial advice”. But for real, as long as you’re not stupid, only spend what you can genuinely afford and pay off your card in full at the end of each month (we recommend a direct debit), you shouldn’t have any issues.

There’s a reason why bank directors do things like naming their yacht “Overdraft” - banks and credit card providers like AMEX make lots of money from the stupid behaviour of consumers. As long as you follow the best practices outlined in this blog, you’ll be able to travel the world for free.

Oh, I forgot to mention that I'm planning to travel by private jet this year and will also share some tips on how to charter a private jet for the cheapest price!

Have any other tips for how to fly for free with credit cards? Drop us a message.